From Flamemobiles to the beaches of Hawaii: My Professional Odyssey

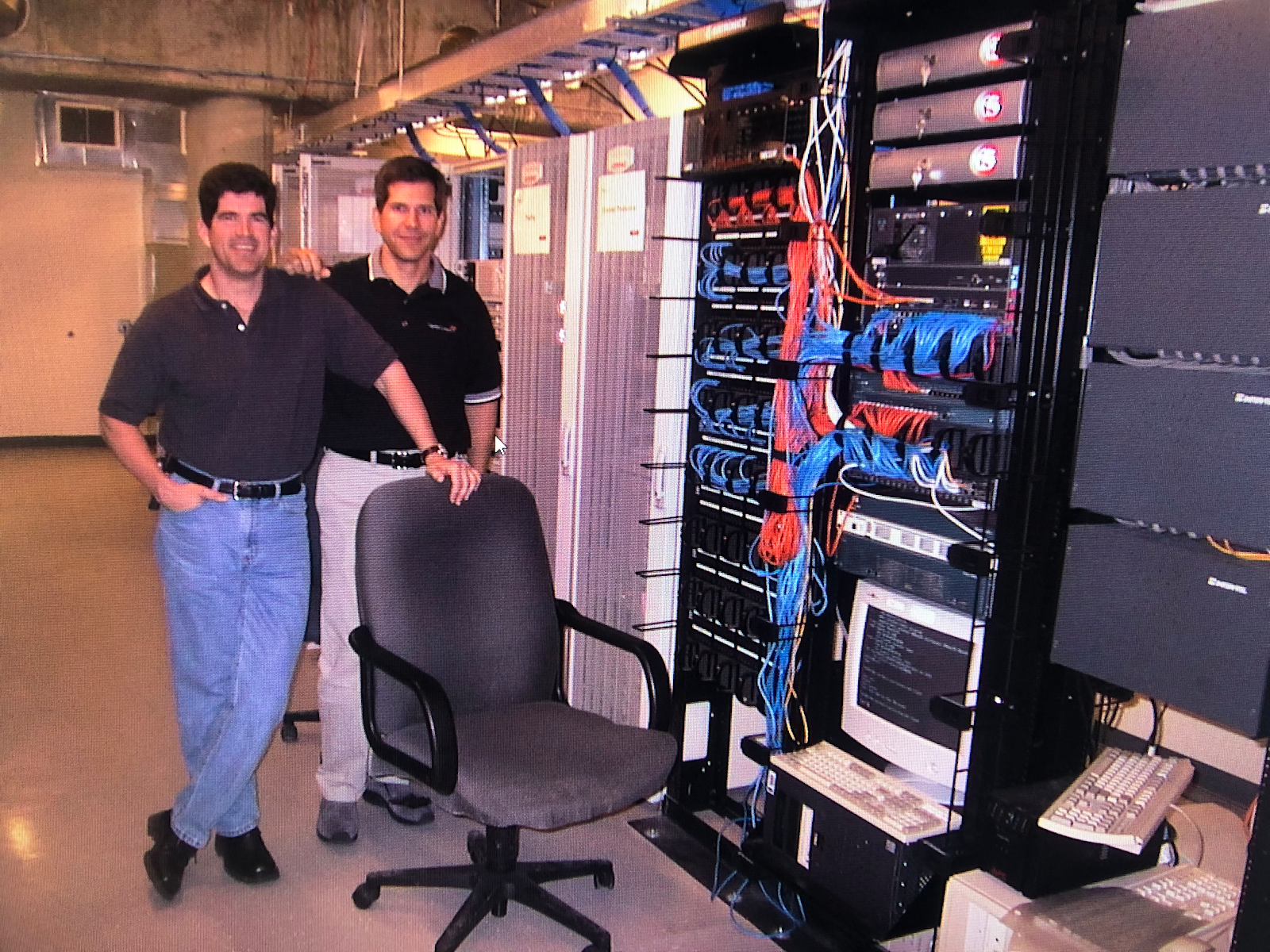

Me (on the left) and my brother, Cliff with our new servers at CapitalStream. I blame the 1979 Ford Pinto. In my final year at Washington State, I was contemplating law school, student loans, and a car with a peculiar talent for catching fire when rear-ended—the only source of my transportation. My brother, Cliff, convinced me that a better option was to join him and make millions as a tech entrepreneur. While I was studying in Japan and traveling around the world on my way home, he had given up his aspirations for medical school and launched a POS systems integration business. The prospect of riches won out over debt and the flamemobile. As a systems integrator, we found a few challenges we needed to continually overcome. First, because we didn’t own the software, the ISV could make or break our business. We also noticed financing created a barrier. Most of our systems were leased, and the lease approval process would take two weeks. We thought it would be a clever idea to build a sof