From Flamemobiles to the beaches of Hawaii: My Professional Odyssey

I blame the 1979 Ford Pinto. In my final year at Washington State, I was contemplating law school, student loans, and a car with a peculiar talent for catching fire when rear-ended—the only source of my transportation.

My brother, Cliff, convinced me that a better option was to join him and make millions as a tech entrepreneur. While I was studying in Japan and traveling around the world on my way home, he had given up his aspirations for medical school and launched a POS systems integration business. The prospect of riches won out over debt and the flamemobile.

As a systems integrator, we found a few challenges we needed to continually overcome. First, because we didn’t own the software, the ISV could make or break our business. We also noticed financing created a barrier. Most of our systems were leased, and the lease approval process would take two weeks.

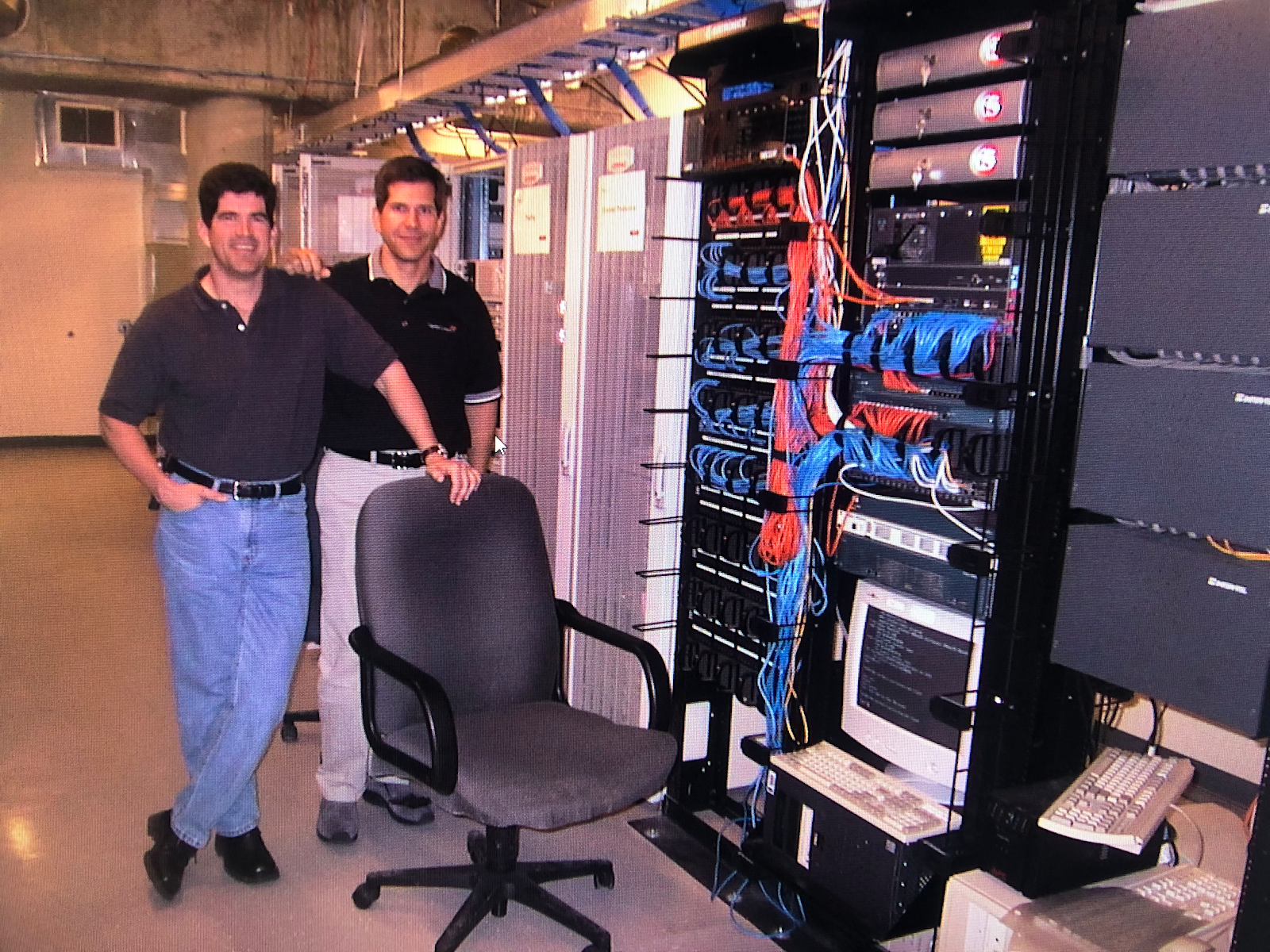

We thought it would be a clever idea to build a software solution that would address the paperwork and application process faced by the leasing brokers to speed things up. That idea evolved into CapitalStream. We pioneered online business credit scoring and built a leading loans origination platform, reducing the approval process to twenty seconds. With over $50MM in venture finance, its clients included Bank of America, GE, Fleet, Merrill Lynch, and others (CapitalStream was eventually sold to HCL).

When we shifted our focus from being a Systems Integrator to an ISV, my role evolved from sales to operations. I became the point person for investor relations, leading the HR and Accounting teams. Once we secured our series B for CaptialStream, I shifted to a second startup we had incubated, a company called WorkWise that launched the first HR application on the Windows platform and later an OLAP application to integrate HR and Accounting databases.

Following our series A round, we sold WorkWise to Oralis.com shortly before the internet bubble burst. That time was challenging. The Oralis deal was all stock, and our equity in CapitalStream took a massive hit before we had a good exit option. But I am proud of what we were able to accomplish during a time when we didn’t know anything and there were no good role models.

What I know about enterprise sales, SaaS pricing, building sales teams, program management, and investor relations can be traced back to my time building CapitalStream and WorkWise.

The upside to the sale of WorkWise and the down market was that I was single and had some time on my hands. I took a sabbatical year and traveled around the world again (to the west this time). Within three months of my return, I met my wife and landed a job with a company called Zango that needed somebody to work with ISVs and distribute their search/shopping toolbars.

Within three years at Zango, I was able to scale their distribution by building an international team (Montreal, Seattle, Tel Aviv) and create an affiliate network from the ground up. We distributed well over 100 million applications and accelerated sales from $5 million annually to $70 million. This position required us to leverage analytics to acquire users at less than 30% of their lifetime value in order to maintain our targeted EBITDA greater than 20%. I stayed with Zango until after they were acquired by Tremor International (TRMR) fka Blinkx.

While I was at Zango, my brother Cliff worked with the founders of Docusign to help them secure some early key accounts and Enom as they transitioned to Demand Media before they went public. When I left what was Zango I teamed with Cliff at Ramp Equity and Ramp Catalyst.

Ramp Equity focuses on seed-stage companies, while Ramp Catalyst has an emphasis on divestitures, mergers, and acquisitions. At both we work on behalf of family offices that invest in early-stage tech companies and use us to accelerate value. My initial mission was to help craft and execute go-to-market strategies for the portfolio companies. This typically had me filling the role of VP of Marketing, VP of Sales, or go-to-market (GTM) strategy development.

I held a number of interesting positions during this time. At Red Foundry, I was VP of Revenue for a mobile application developer platform that crafted deals with Samsung, Random House, Wine Enthusiast, and Expedia. At Utrip, I was VP of Sales for a platform using AI to build customized travel itineraries for clients like Holland America, Hilton Hotels, Starwood, and JetBlue.

My time with AngleMD was fun because I had a chance to act as their CMO. I led a staff of young content developers using social media, podcasts, and webinars to attract angel investors with medical and life science backgrounds. I was able to grow that network by 20,000 members within the first year at an average $14 CPA.

Recently, I sat for the FINRA Series 82, FINRA SIE, and the NASAA Series 63 exams. By passing those, I qualified per the SEC to register with FINRA for the sales of private equities. That registration is through Umergence, an independent broker-dealer based in Connecticut. This allows Ramp Equity and Ramp Catalyst to leverage me in pursuit of a wider range of M&A transactions.

The next chapter of my career will take place in Hawaii. My wife and I, drawn by the allure of Oahu, made the move at the end of the pandemic. While the professional landscape here may have its limitations, we didn't choose this paradise for our careers; we chose it because it's where we wanted to be.

Gone are the days when my car doubled as a potential molotov cocktail. Hawaii has brought a change of scenery and a different pace. Working remotely, I've had the privilege of collaborating with fantastic individuals on intriguing and innovative ventures. In this tropical haven, my hope is to continue contributing to businesses, helping them accelerate their journey towards value and success.

Comments

Post a Comment